Disruptive fingerprint technology company Touch Biometrix has secured funding to

progress its plans to eradicate the need for computer and mobile phone passwords.

The initial £150,000 seed investment from Deepbridge Capital will enable the

business to develop new fingerprint sensors which will revolutionise a range of

consumer electronics and enhance security for users.

Touch Biometrix was founded in 2017 by Dr Mike Cowin with the aim of becoming

one of the top five fingerprint sensor suppliers in the world by 2023. Mike is

regarded as one of the industry’s leading experts.

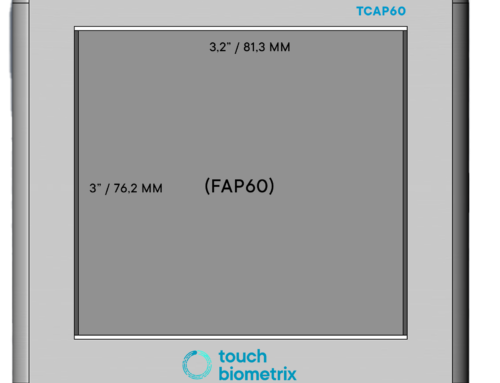

Based on proprietary technology and sensing algorithms, the company is developing

a range of fingerprint sensors of any shape or size for a more convenient user

experience on a wider range of products including smartphones and laptops.

Dr Cowin, Chief Executive of Touch Biometrix, which is based in St Asaph, said: “Our

new manufacturing model is set to disrupt the market in terms of performance and

cost, at less than $1 a unit. Fast, secure and impossible to spoof, our technology will

eliminate the need for passwords.

“We will be using the money from the initial seed funding round to establish a

minimum viable product in collaboration with our supply chain partners.

“The demand for user authentication and mobile payment services is driving

tremendous growth. The industry predicts that biometrics will be standard in 90% of

mobile devices in the next four years generating 1.37 trillion mobile device

transactions.”

Ian Warwick, Managing Partner at Deepbridge Capital, said: “We are delighted to be

working in partnership with Touch Biometrix at what is an exciting time for the

biometric industry.

“We understand there is an increasing need for secure user authentication

technology and we believe Touch Biometrix has the capability to move quickly in this

market.” The market demand for fingerprint sensors is expected to exceed 1.5 billion units per

year by 2020 with the global market for biometrics predicted to reach $15 billion by

2025. Deepbridge Capital, which is based in Chester, provides funding to a portfolio of

growth-focussed technology and life sciences companies across the UK.