Touch Biometrix is a rare startup on the biometric fingerprint sensor market, with major ambitions and a new approach to sensors based on proprietary technology and active capacitive thin-film transistor sensing arrays.

The company is a fabless developer of capacitive fingerprint sensors, manufactured using thin-film transistors (TFTs) on glass or plastic, called TCAP.

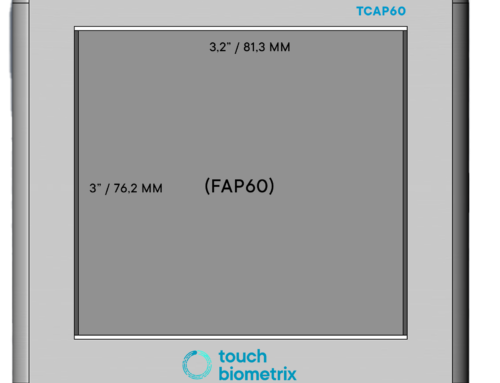

The company’s first commercially available products will be a range of large area sensors to replace bulk optical sensors, Touch Biometrix Founder and CEO Mike Cowin told Biometric Update. The sensors which Cowin says will have a thin form factor, much lower cost of ownership and low power consumption, will be launched in the third quarter of 2021, and be suitable for mobile applications like police and border checks.

The company was founded in 2017, and reached operations in early 2018 after receiving seed capital. Touch Biometrix has since raised £2 million (US$2.6 million) in series A funding.

Cowin says the company’s team are all “display guys” who have worked in the TFT-based industry, with a collective experience of over a century. While the team is relatively new to biometrics, they see a gap in the fingerprint sensor market and a fast way to leverage value in the display industry.

“We saw that small area silicon sensors were severely limited in the potential for cost reduction as the drive to reduce cost meant ever smaller sensors,” Cowin explains. “There’s only so many sensors you can squeeze out of a 12” wafer. Also, the rigidity of the sensor limited the application potential to a wider range of products. On the flip side, large area optical solutions were bulky and crazy expensive.”

Cowin and the rest of the team set out to drive down the cost of ownership, while also opening up a new range of applications through their experience in flexible TFT production. In those applications, the sensor conforms to a 3D surface, such as a door handle or a whole computer mouse.

In the display industry, economies of scale have driven production towards larger plate sizes, leaving unfilled capacity among smaller production lines which Touch Biometrix plans to tap into “using the same baseline TFT process,” Cowin explains.

Touch Biometrix has built a successful proof of concept large area TFT-based sensor on glass, which worked perfectly, according to Cowin. The image quality at 508ppi was “amazing” without the use of image correction techniques.

“In fact, being newbies to the game of biometrics we spotted dots along the ridges of the finger that we initially thought were defective transistors, until we realized that they were actually sweat pores,” he writes. “This allows simultaneous fingerprint and sweat pore pattern recognition for increased security in use.”

The company is also developing a solution for biometric smart cards with its TCAP technology that Cowin says will make it viable for mass adoption for the first time, with a price point of $8 per biometric card.

Current solutions are close to $20 each, according to Cowin, which would need to be cut in half to make it viable for mass adoption and user acceptance.

Cowin also notes that a Finnish study at an airport detected traces of the novel coronavirus and other transmissible diseases on the buttons of a payment terminal, and almost nowhere else. This gives greater urgency to implementation and launch plans.

Customers will find that silicon is not the best fit for the purpose, Cowin claims. The smaller fingerprint sensor sizes necessary to meet the required cost will impact false rejection rates too greatly for the sensors to be considered reliable. The leading fingerprint sensors being promoted still cost around $3 each, he says.

Touch Biometrix is aiming to offer its TCAP TFT sensor at only $1.50 a piece, and they can also be printed over without affecting performance. This not only provides branding and appearance benefits, but also opens up the possibility of a full-surface sensor for what Cowin describes as “a truly frictionless and fast user experience with a lower FRR to boot.”

“There are a number of other technical challenges we can overcome,” he states. “Our plastic sensors are extremely low power and can be laminated flush onto the card as a final step in the production process with no requirement for a bezel, so increasing yield but also reducing integration costs further. It also means that no post installation calibration is required. Some sensors require almost two minutes per card to calibrate post lamination, so 2 million cards would take 3.8 years to calibrate.”

The flexibility and robustness of the sensors is another natural advantage, Cowin says. Repeated bend tests in the millimeter range show no loss in performance for the TCAP TFT sensors.

The material also enables the economy of scale to drive costs down, as the TFT lines Touch Biometrix’ sensors are manufactured on use plates that are almost a meter by a meter in area. Glass or foil substrate material costs are 50 to 100 times cheaper than silicon, Cowin says. The typical production line can manufacture 20,000 to 30,000 plates a month to meet demand for high-volume biometric smart card production.

The first result of the process, with a new simplified inlay that the company believes will significantly lower production costs will be a FAP20 unbreakable plastic sensor with 508ppi.

Cowin and Touch Biometrix believe fully in the future of the biometric smart card market, and their technology’s place in it. Recently, the company has expanded its focus from building up its intellectual property portfolio to its current 23 patent families to also identifying production and supply chain partners.

“We are now driving towards our first product launches and we expect to dominate the market in the coming years with our unique technology proposition and production partners,” Cowin says. “We are living in exciting times.”